Get a Virtual Credit Card today

Virtual Credit Cards in Norway

Compare the rewards

See what credit card fits you

Apply today and get an instant answer

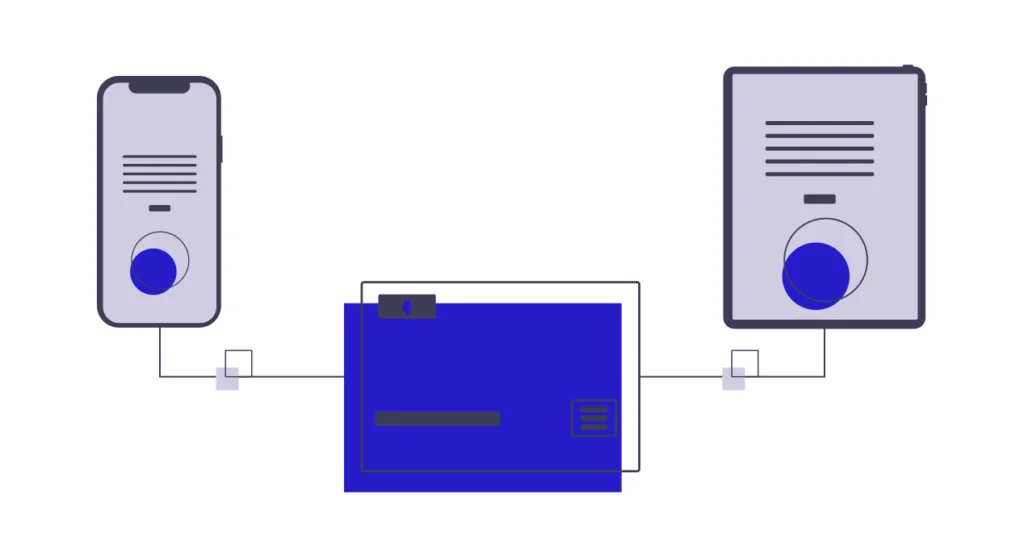

Virtual credit cards in Norway come in two forms: extensions of your existing bank accounts and standalone virtual accounts you can set up online. The first type enhances security for your current bank or credit card by generating temporary numbers for transactions and protecting your main account details. The second type offers a separate, fully digital credit card account, providing a secure and flexible option for online purchases without linking directly to your primary finances.

We’ll explore how both options can fortify your online shopping, offering advanced security and convenient financial management in Norway’s digital marketplace.

How to Apply for a Virtual Credit Card

Applying for a virtual credit card in Norway, whether it’s linked to an existing account or a new standalone digital account, is a straightforward process.

For Virtual Cards Linked to Existing Accounts

- Access Your Online Banking or Credit Card Account: Log in to your online banking platform or credit card account where you want the virtual card to be linked.

- Navigate to the Virtual Card Section: Look for the virtual credit card feature within your account’s services or features section.

- Request a Virtual Card: Follow the prompts to generate a new virtual card. Some institutions may offer instant issuance, while others might require a short processing time.

For Standalone Virtual Credit Cards

- Research Providers: Start by researching companies that offer standalone virtual credit cards in Norway. Compare their features, fees, and security measures.

- Complete the Application: Visit the provider’s website and fill out the application form. You’ll likely need to provide personal details, verify your identity, and possibly link a funding source.

- Set Up Your Account: Once approved, you’ll set up your virtual credit card account, which may include creating login credentials and preferences for your card’s use.

In both cases, it’s essential to understand the terms, fees, and usage policies associated with your virtual credit card. Once you have your virtual card, you can start using it for online transactions, enjoying enhanced security and control over your digital spending.

What is a Virtual / Digital Credit Card?

A virtual or digital credit card serves as an online version of your traditional credit card, designed to be used for internet transactions without exposing your real card details. This innovative financial tool generates a unique card number, expiration date, and security code, which can be used for online shopping, subscriptions, or any digital payment, offering an extra layer of security.

Here’s a closer look at how these cards work:

- Unique Card Numbers: Each virtual card number is unique to a specific transaction or set of transactions, which means that if the details are compromised, the risk of fraudulent charges on your actual account is significantly reduced.

- Control and Flexibility: Many virtual cards allow you to set spending limits, validity periods, and even merchant-specific usage, giving you control over how and where your card is used.

- Easy Integration: For virtual cards linked to existing accounts, they integrate seamlessly with your current banking setup, allowing you to manage your finances all in one place.

- Enhanced Security: By not sharing your real credit card number, you safeguard your primary account details from potential exposure during online transactions.

- Instant Issuance: Virtual cards can often be generated instantly, providing immediate access to a credit source without waiting for a physical card to arrive in the mail.

Whether linked to an existing account or as part of a new standalone digital service, virtual credit cards in Norway offer a secure and modern solution to online spending, aligning with the digital age’s demand for enhanced cybersecurity and financial management.

Compare the Best Virtual Credit Cards in Norway

Virtual credit cards differ by provider, control features, and how they integrate with your existing finances. Some are standalone apps, while others extend your current credit or debit card with added security. Here’s a quick comparison of the best options available in Norway:

| Card Name | Type | Fees | Spending Control | Best For |

|---|---|---|---|---|

| Revolut Standard | Standalone virtual card | 0 NOK/month | Yes – set limits, freeze | Online shopping & travel |

| Curve | Virtual card hub | 0–960 NOK/year | Yes – link multiple cards | Managing several payment cards |

| Wise Virtual Card | Prepaid debit (multi-currency) | Low FX fees | Yes – per transaction cap | International payments & control |

| Nordea Netbankkort | Linked to Norwegian bank | 0 NOK | Yes – time limits & locks | Existing Nordea customers |

Each of these cards offers instant issuance, improved online security, and varying degrees of spending control. Revolut and Wise are ideal for flexible online and cross-border use. Curve suits users juggling multiple cards, while Nordea’s option is best if you want to enhance security within your existing bank relationship.

Pros and Cons of Virtual Credit Cards

Virtual credit cards are designed for digital convenience and security, but they’re not without limitations. Here’s a balanced overview of the key advantages and drawbacks.

Pros

- Enhanced online security

Your real card number stays hidden, reducing the risk of fraud or data theft during online purchases. - Instant issuance

Get a usable card number immediately – no need to wait for physical delivery. - Full spending control

Set transaction limits, expiration dates, or restrict usage to specific merchants or categories. - No risk to your main account

If a virtual card is compromised, your primary card or bank account remains unaffected. - Ideal for subscriptions

Avoid recurring charges by using short-lived or merchant-specific cards.

Cons

- Limited in-store use

Unless integrated with Apple Pay or Google Pay, virtual cards generally can’t be used at physical terminals. - Not accepted everywhere

Some merchants, especially those using older systems, may reject virtual card numbers. - Fewer reward programs

Virtual cards often lack the full range of bonuses and benefits that come with traditional credit cards. - May require external apps

Managing virtual cards often involves third-party platforms, which may not appeal to all users.

Understanding these pros and cons helps you decide if a virtual credit card aligns with your spending habits, risk tolerance, and preferred way to manage money online.

Who Should Use a Virtual Credit Card?

Virtual credit cards are ideal for anyone who wants more security and control over their online spending. Below are the key user groups that benefit most from this type of payment solution.

Frequent Online Shoppers

If you shop frequently online, a virtual card protects your real card details from being exposed to potential data breaches. You can also set one-time usage, spending limits, or merchant restrictions to prevent unauthorized charges.

Freelancers and Small Business Owners

Virtual cards are useful for separating business and personal expenses, especially for online subscriptions and software tools. Many platforms allow you to create multiple virtual cards for different vendors, helping with bookkeeping and spending control.

International Travelers

Using a virtual card abroad for online bookings or services reduces the risk of card fraud and lets you manage spending in multiple currencies, especially with providers like Wise or Revolut.

Parents Managing Teen Spending

Virtual cards allow parents to give their children limited access to online funds with built-in controls. You can cap spending, restrict usage to specific websites, and disable the card instantly if needed.

Privacy-Conscious Users

If you’re concerned about tracking, unwanted renewals, or exposing personal banking details, virtual cards are an effective privacy tool. You can cancel or replace card numbers without affecting your main account.

Can You Use Virtual Cards in Stores?

Virtual credit cards are primarily designed for online transactions, but some can also be used for in-store purchases—if they support mobile wallets.

Via Apple Pay or Google Pay

Many virtual cards can be added to Apple Pay, Google Pay, or similar digital wallets. Once added, you can use your smartphone or smartwatch to make contactless payments at any terminal that accepts NFC payments. This setup allows you to use a virtual card just like a physical one—without ever needing to carry a plastic card.

Limitations to Be Aware Of

- Not all banks or card providers in Norway support mobile wallet integration for virtual cards.

- Some merchants still require a physical card for verification, especially for hotel check-ins, car rentals, or large in-person purchases.

- Virtual-only cards that don’t support wallets cannot be used in physical stores.

If in-store usage is important to you, always verify that the virtual card provider supports wallet integration before applying. Otherwise, you may be limited to online-only transactions.

FAQ

Frequently Asked Questions

A virtual credit card is a digital version of a traditional credit card, providing unique card details for online use to protect your actual account information.

Apply through your bank or a virtual card provider. For banks, access your online account; for standalone cards, fill out an application on the provider’s website.

No, virtual credit cards are primarily designed for online, phone, or mail-order transactions, not for in-store use.

Fees vary by provider. Some banks offer virtual credit cards for free as part of their existing services, while standalone providers might charge fees.

Yes, many virtual credit cards allow you to set spending limits, transaction limits, or validity periods for enhanced control.

Yes, you can generate multiple virtual cards, especially useful for managing different subscriptions or online transactions.

Opdateret: